During the second Circular Shift interregional meeting in Mechelen, Anne Rademaker and Rebecca Scholten delivered the second Circular Shift Masterclass: "From data to decisions: Impact monitoring for Circular Procurement". Their masterclass introduced the transitional role of procurement as a tool not only of purchasing power but also climate impact. Then, highlighting the global trends of material demand, waste generation, and the growing middle class, they outlined the significance of legislation as well as business frameworks such as ESG.

The masterclass focused on impact monitoring and forecasting, beginning with the question: How to decide what is considered circular during procurement? Without a unified definition of circular economy, and without a unified framework to measure it, it is difficult to grasp the impact of circularity in procurement. Furthermore, how can we answer this question without everybody in the value chain involved (value chain collaboration) and convinced about the concept of "value"? Or when data from our own operations and value chain cannot even always be trusted?

Essence of impact monitoring

Foundations of Impact Monitoring in Circular Procurement:

- A shared definition of Circular Economy

- A unified circularity framework

- A clear understanding of value

- A system you can trust (data quality + governance)

Pathways to better circular decisions:

- The structural route: follow the EU's ESPR (Ecodesign for Sustainable Products Regulation) and leading best practices.

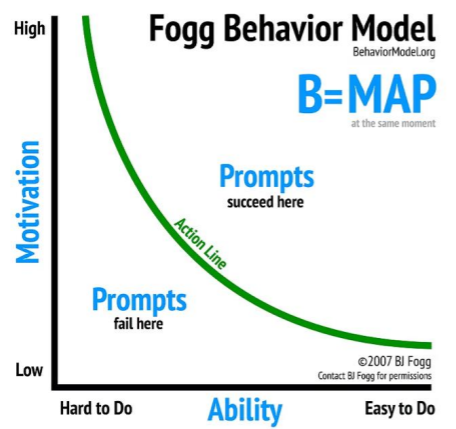

- The behavioural route: apply the Fogg behaviour model.

The structural route

Green public procurement will become mandatory in the EU progressively from 2026–2027 onward, depending on the product group, through the new Ecodesign for Sustainable Products Regulation (ESPR).

- Full EU-wide mandatory green public procurement (GPP) across most priority sectors is expected by 2030.

- Phones, laptops and workwear are all priority product groups under ESPR as defined in the ESPR Working Plan.

What is expected to be done?

- Include circular performance requirements in the tender.

- Require Digital Product Passport (DPP) information.

- Track lifetime performance and monitor usage.

Examples of the structural route

Frameworks such as the ISO 59020 standard on circular economy, ESG, or the EU Corporate Responsibility Sustainability Directive (CSRD) offer concepts of value retention across multiple lifecycles, differentiate between higher and lower circular strategies, and use the same families of indicators, such as value, material, waste, and lifetime.

The Circular Benchmark Tool is another benchmarking tool to measure regional circular economy performance.

The behavioural route

Motivation, ability & prompt

Motivators: pleasure/pain, hope/fear, social acceptance/rejection.

Ability: Simplicity factors e.g. time, money, physical effort, brain cycles, routines.

Prompt: a trigger to activate people at the right place and time. It has to be noticeable, associated with a target behaviour, and happen when we are motivated and able.

Breakout sessions on workwear, laptops, and phones

Following the presentation, the participants split into three groups to discuss the respective product groups tackled by Circular Shift. They identified the key stakeholders, KPIs, risks, and opportunities for circular procurement of phones, laptops, and workwear.

For all product groups, end users are identified as important stakeholder because they have to accept the products. Suppliers and the laundry or repair services are important as there might be a value placed on the personalization of the item, when staff don’t want to share. Internal departments are also a key stakeholder to involve; in many procurements you might to deal with a legal department, a purchasing department, a sustainability team, an IT department, a repair team, and possibly even one or more political decision-makers.

What stood out was the regional differences in structure and roles within the procurement process. In the Netherlands the person working on the procurement process might not be the contract manager when the contract is signed. Larger higher up decision-making bodies might be involved in France, whereas in the other regions, this is not so.

External stakeholders such as repairers are also a key stakeholder, as are more distant - but still important - players such as the natural environment, indigenous communities, and others affected by material extraction and/or pollution.